- The New National Childcare Scheme supports all children in childcare registered with Tusla who are at least 24 weeks old through a grant paid to the provider. An hourly grant is paid.

- A basic payment up to age 36 months or when the child enters ECCE if later, paid without a means test of €0.50/hour or €22.50 per week for the max 4/5 hours.

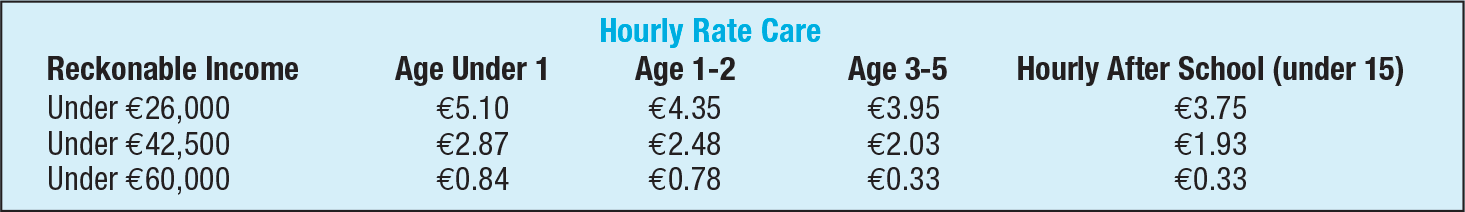

- An enhanced grant for those whose eligible income is under €60,000, {where income excludes taxes, secondary benefits, student grants, pension contributions and a multiple child discount of €4,300 (two children under 15) €8,600 (more than 2 children under 15)}. The hourly rate falls with rising income and rising age. Up to 45 hours care per week can be claimed where no parent is available to care for the child (ie. Working or studying) otherwise the max is 20 hours. It applies to outside the school term also.

- Free Early Childhood Care and Education is available for two years to any child aged more than 2 years and 8 months until they are 5 and a half or make the transition to primary school, and covers 3 hours daily. An eligible child must enrol in September. A pre-school cannot charge parents extra for the hours covered by the scheme.

- AIM (Access Inclusion Model) supports participation by children with special needs, through a range of supports towards a trained Inclusion Coordinator, specialist equipment, therapy services, and in some cases funding for classroom support. (See pobal.ie).

- If a child has a diagnosis of autism, he or she can access 10 hours of home tuition per week from age 2.5, and from age 3 a place in Early Intervention Class (if available) or 20 hours home tuition until school entry.

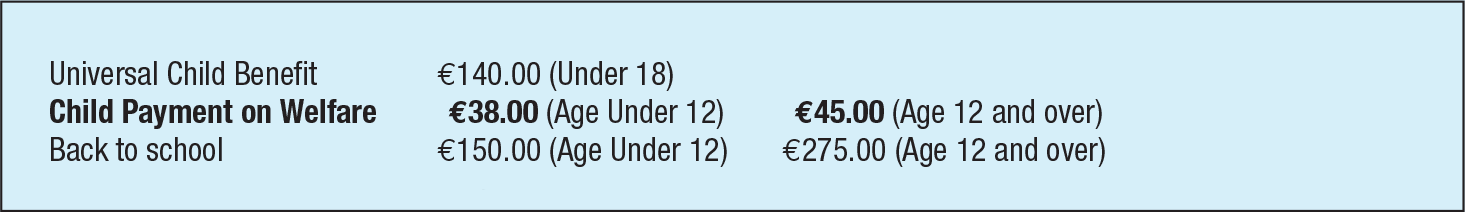

- The Basic Child payments in 2021 are:

Child Benefit is paid up to the 18th Birthday if in full time education. Back to School payments can be claimed by those on Working Family Payment or Back to Work/Education Schemes. The Widowed or Surviving Partner Grant is increased to €8,000 (Jan 2021).

- Maternity Leave is 26 weeks with 16 additional weeks unpaid maternity. Maternity Benefit is payable for 26 weeks starting 2 weeks before the expected date of birth. Extra leave and benefit applies for a premature birth, for the duration between the actual date of birth and the 38th week of the pregnancy.

- Paternity Benefit for 2 weeks of €245 per week is now payable for births or adoption. During 2021, Parental Benefit will be extended to five weeks at €245 per week payable to each parent of a child in their first year. Unpaid Parental Leave has been extended to 26 weeks and can be taken up to when a child reaches 12 years of age.

- Working Family Payment (formerly FIS): A couple or a single parent on low pay, who work for at least 19 hours per week combined (including job-sharers), can get a supplement for their children (including those 18-22 in full-time education). The payment is calculated at 60c for each E1 by which your net family income (i.e. net of tax, USC, PRSI and superannuation) falls below the income thresholds. Maintenance of up to €95.23 is disregarded from family income as is half of the remainder in determining your assessed net family income. In 2021 the thresholds are:

– €541 for a family with one child, plus

– €101 for second, €101 for third, €91 for fourth, and €126 (approx) for each additional child.

If you qualify, the payment will be awarded for 52 weeks. It will not affect your eligibility for a Medical Card or One Parent Family Payment.

- Support for Caring at Home

- A tax credit of €3,300 is claimable if you are supporting a child whose incapacity makes it unlikely they will be able to maintain themselves. It requires a declaration by a doctor. For other Dependant Relatives the credit is €245.

- Tax Relief at your top rate of tax up to €75,000 can be claimed to employ a Home Carer or to pay an agency for such a service for an incapacitated person

- A Home Carer Tax Credit of €1,500 is available to a partner in a one-earner family who is caring for a disabled person

- The Dept of Social Protection pays Domiciliary Care Allowance of €309.50 per month and an annual Carer’s Support Grant of €1,700 up to their 16th birthday for children with a severe disability who require substantial and documented extra care. It also confers automatic entitlement to a Medical Card for the child. A half-rate payment is payable to a child in institutional settings who lives at home for 2 days or more. At 16, the child may apply for Disability Allowance.

- Home Support is available offering home help or a homecare package depending on need. Eligibility is based on a Care Needs Assessment by your Public Health Nurse and is not based on a means-test or holding a Medical Card. There is no charge or contribution to be paid for either short or long-term Care Plans.

- Carer’s Allowance: A person who is giving full-time care to a child on Domiciliary Care Allowance, or to any person aged 16 or over requiring full-time care, can apply for a means-tested weekly Carer’s Allowance of €219 (€257 if carer is 66 or over). In the means-test, any weekly income of the carer in excess of €332.50 (single), or half of their own and their spouse’s income in excess of €665 (married) is assessed. The allowance is reduced accordingly. Half rate Carer’s Allowance is payable to persons receiving another Social Welfare payment. Carers are entitled to credited contributions, a GP Visit Card and free travel in their own right. They can take up training or paid employment for up to 18.5 hours per week. Carers Allowance is paid for 12 weeks after the caring ceases and you are eligible for Back to Work, Back to Education or Community Employment Schemes.

- Persons caring full time can qualify for €1,850 Carer’s Support Grant paid in June regardless of means, but persons working over 18.5 hours or on Jobseeker payments will not qualify.

- A Carer’s Benefit of €220 based on your Social Insurance contribution can be claimed for short-term absences from work (up to 24 months) for caring responsibilities. Limited work earning up to €332.50 per week is permissible. And you are entitled to a GP Visit Card.

Need assistance with a Family or Caring related query?

Complete the short enquiry form below and my office will be in touch to assist further.