Taxation

The focus for tax changes in 2021 is to help people through Covid. VAT for Tourism, Hospitality and Hairdressing is cut to 9% for the next 14 months. Relief for remote working is improved. Expected changes in Local Property Tax have been postponed. Concessions to help enterprises cope are extended.

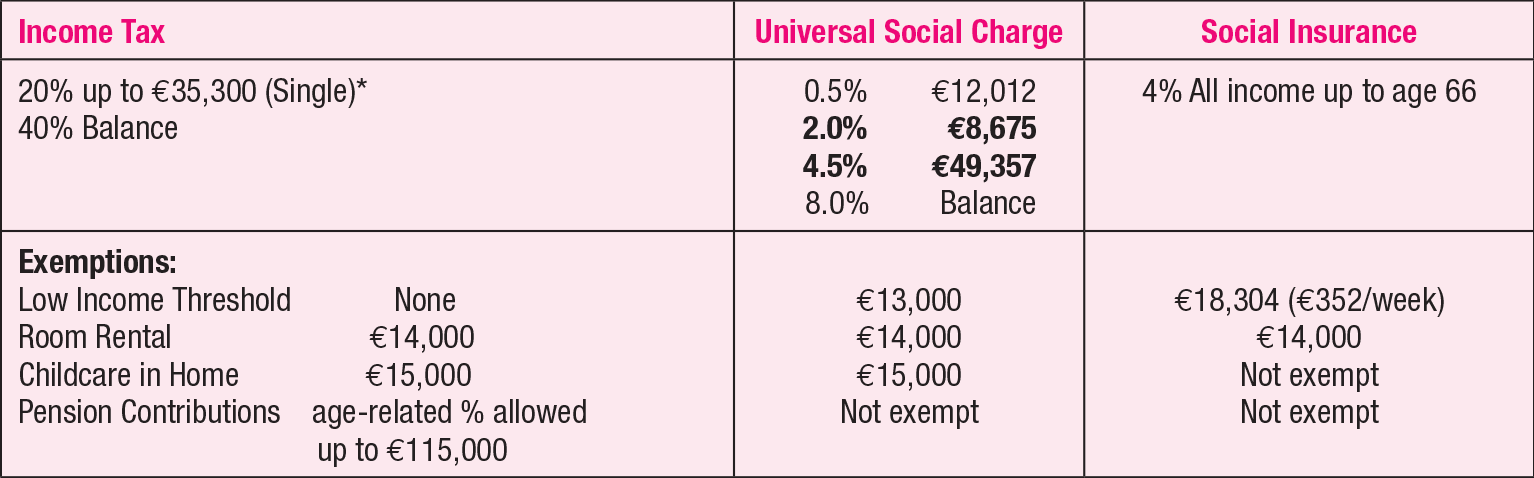

- The following are the core taxes which apply to income in 2021:

* This Standard rate Cut-off point is €4,000 higher for a Single Parent, €8,000 higher for a couple with one earner and double for a couple both earning.

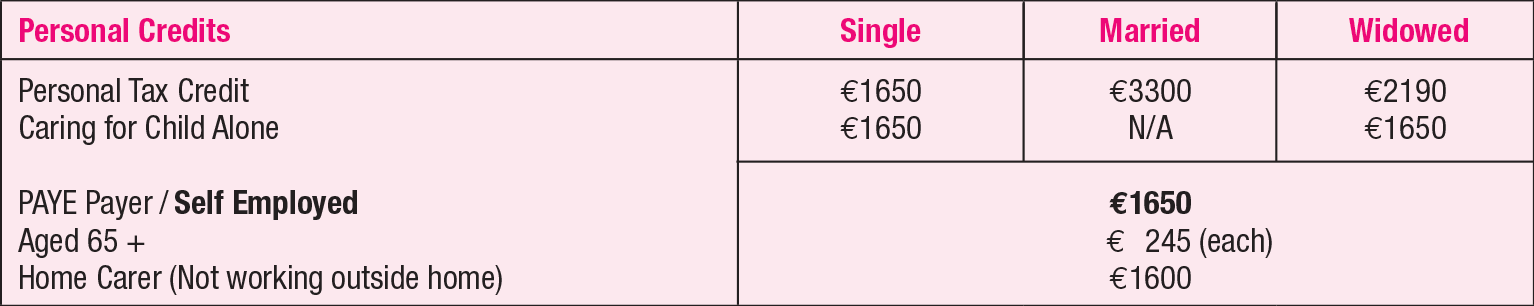

- General Reliefs: the gross liability to Income Tax is reduced by Tax Credits which you can claim

Special Reliefs

- A parent with dependent children who is widowed gets an additional tax credit in each of the 5 subsequent tax years

of €3,600, €3,150, €2,700, €2,250 and €1,800 respectively. - All unreimbursed Health Care Expenses incurred at home or abroad carry a 20% tax credit once recommended

by a registered professional. A Psychological Assessment and Speech Therapy for children also qualifies. Routine

Dental or Optical Care don’t qualify. Payments to Nursing Homes are allowable at your top rate of tax. - Insurance to cover long-term care costs and non-routine dental costs carry a 20% tax credit.

- Persons aged 70 or over and Medical Card holders whose aggregate income does not exceed €60,000 pay a maximum 2% of USC.

- DIRT Tax: A single retention tax of 33% applies in 2021 to interest earned on ordinary deposit accounts, investment accounts and all Credit Union accounts. Persons who are 65 and over, or permanently incapacitated, can, if your total income is not sufficient to make you taxable, notify your bank and receive the interest without deduction of DIRT.

- Local Property Tax: The proposed change in the Valuation Base has been postponed, so in 2021, LPT chargeable to the owner of a residential property will remain at a rate of 0.18% of the market value on 1 May 2013 as fairly assessed by that owner (a higher 0.25% applies to the excess over €1 million).

- Capital Acquisition Tax: Gifts or inheritances bear a 33% tax on the market value of the assets received in excess of certain thresholds which vary according to your relationship with the giver – €335,000 for a son or daughter; €32,500 grandchild/brother/sister/niece/nephew/parent: €16,250 all others.

- Carbon Tax is increasing by €7.50 per tonne to €33.50, immediately for Motor Fuels, and from 1st May for Home Heating Oil and Solid Fuels. It will rise each year to 2030. All of the extra money will be used to help families adapt to Climate Change.

- Electric Vehicles qualify for up to €5,000 relief in VRT on fully battery electric cars priced up to €40,000, tapering to zero over €50,000, the lowest €120 rate of Motor Tax, 50% off tolls (25% PHEV) plus up to €5,000 Purchase Grant and €600 towards a home charger.

- Remote Working: An employer can pay up to €3.20/day free of all tax to e-workers to cover expenses, and Benefit In Kind does not apply to employer-provided equipment or broadband services. Where an Employer does not make a contribution, an e-worker can claim Tax Relief on heat, light, broadband and on vouched expenses used wholly, exclusively and necessarily for their work.

Need assistance with a Taxation related query?

Complete the short enquiry form below and my office will be in touch to assist further.